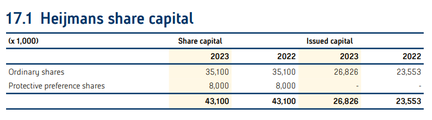

The Heijmans share capital

Issued capital as of 30 May 2024

| Share class | Number ofissued shares | Nominal value per share | Nominal value issued capital | % of total | Voting right per share | Total voting rights | % of total |

|---|---|---|---|---|---|---|---|

| Ordinary shares | 27.478.006 | € 0,30 | 8.243.401,80 | 100% | 1 | 27.478.006 | 100% |

The composition of the share capital of Heijmans N.V. as at 31 December 2023 was as follows:

Ordinary shares

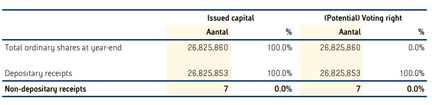

The shares are held by the Heijmans Share Administration Trust (SA Trust). The face value per ordinary share is € 0.30. The SA Trust had issued 26,825,853 depositary receipts for shares as at 31 December 2023, and these shares are listed on the NYSE Euronext stock exchange in Amsterdam. As per the amendment to the articles of association dated 6 September 2023, each ordinary share has been allocated one vote. The voting rights on ordinary shares are vested in the SA Trust. Holders of depositary receipts for shares wishing to vote at a shareholders’ meeting are granted an unconditional proxy by the SA Trust.

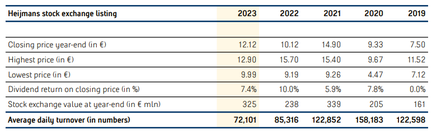

Heijmans N.V. is listed on Euronext Amsterdam. The data relevant to the stock market listing is presented in the table below:

Issued capital and shareholdings

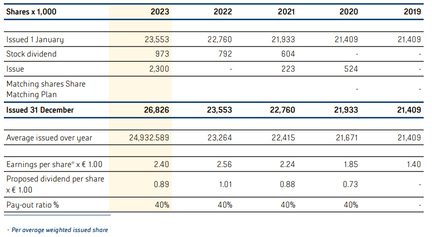

The issued share capital and related voting rights changed on two occasions in 2023: on 4 May 2023 as a result of the issuance of (depositary receipts for) shares in connection with the payment of the dividend on (depositary receipts for) ordinary shares in the form of stock dividend, and on 5 September 2023 in connection with the issuance of 2,300,000 (depositary receipts for) ordinary shares as part of the payment of the purchase price related to the acquisition of Van Wanrooij Bouwontwikkeling.

As per the amendment of the articles of association of 6 September 2023, the voting right vested in the ordinary shares is one vote per ordinary share. The composition of the issued capital and related voting rights as at 31 December 2023 was as follows:

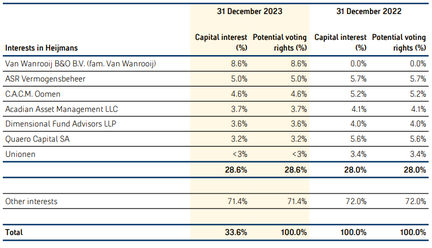

To the best of Heijmans’ knowledge, and also based on the WMZ (Dutch Major Holdings in Listed Companies Disclosure Act) register maintained by the Dutch Financial Markets Authority (AFM), the following investors held an interest of 3% or more in Heijmans as at 31 December 2023:

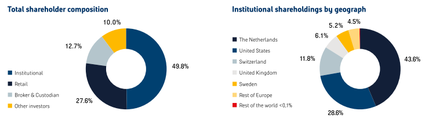

Based on the information provided by banks and custodians and information services, the distribution of share ownership can be broken down as follows:

In the year under review, the (estimated) interest in Royal Heijmans N.V. to the extent held by institutional investors is likely to have increased to 49.8% (2022: 44.6%). Of the number of depositary receipts for ordinary shares held by institutional investors, an estimated 43.6% are held in the Netherlands (year-end 2022: 33.5%). The increase among Dutch shareholders was mainly related to the placement of 2.3 million shares with the Van Wanrooij family as part of the acquisition. Of the number of depositary receipts for ordinary shares held by private investors, the majority are estimated to be held in the Netherlands.

Share price development

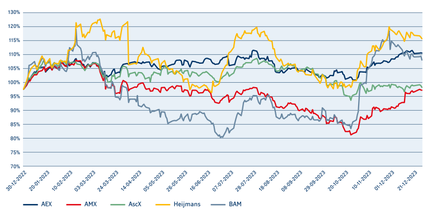

At year-end 2023, the closing price of Royal Heijmans N.V. ordinary shares was € 12.12. This was a 20% increase on the closing price at the end of the 2022 financial year (€ 10.12). This was an outperformance of the AscX index, which increased by almost 1% in the same period. The share price responded positively to the announcement of the Van Wanrooij acquisition on 20 June. This fell back somewhat as interest rates and inflation rates continued to rise during the summer months. At the end of the year, interest rates fell again, which had a positive impact on house sales. Given Heijmans’ greater exposure to the housing market, this is clearly reflected in the share price development. The chart shows the Heijmans share price development in 2023 compared with the AscX index, the AEX and the AMX, as well as to the other Dutch listed construction company BAM.

| Bank | Analist | Telephone |

|---|---|---|

| ABN Amro | Martijn den Drijver | +31 20 628 0042 |

| ING Financial Markets | Tijs Hollestelle | +31 20 501 3517 |

| Kepler Cheuvreux | Tim Ehlers | +31 20 563 2379 |

Contact us